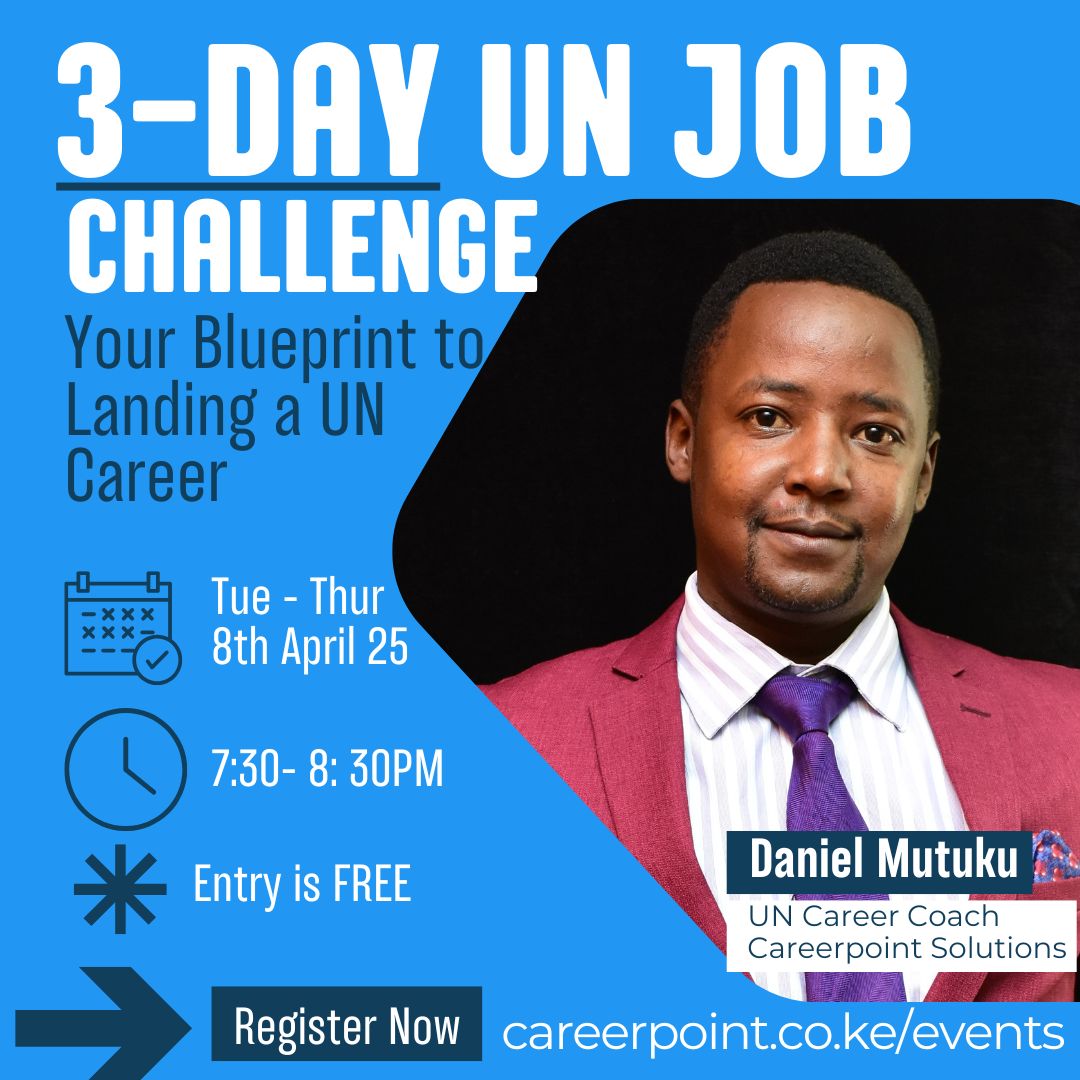

3-Day UN Job Challenge

Your Blueprint to Landing a UN Career!

Register Here

Credit Management jobs, Finance jobs, Business Administration jobs,

Credit Officer (Logbook Loans)

About The Role

We are seeking a highly motivated and detail-oriented Credit Officer to join our team. As a Credit Officer, you will play a crucial role in sourcing, managing and assessing credit applications especially logbook loans from individuals and businesses. Your primary responsibility will be to plan for and drive business growth in terms of clientele, loan portfolio and quality.

Best CV Writing Service: Not Getting Interviews? Your Success Starts with a Stellar CV, Let Us Help You Shine. Get a FREE CV Review - Click Here.

You will also evaluate creditworthiness, analyze financial data, and make informed decisions regarding loan approvals. While ensuring compliance with regulatory requirements and contributing to maintaining a high standard of customer service, you will also be responsible for developing and executing sales strategies that drive revenue for the company, and monitoring and reporting on sales goals, adjusting tactics as needed to reach them.

We invite you to join our dynamic team and contribute to the growth and success of our digital bank by playing a key role in ensuring responsible and efficient credit operations.

Responsibilities

- Process ownership: Owning and managing the sourcing, negotiating, signing, and management of logbook loan accounts.

- Evaluate credit applications: Review loan applications submitted by individuals and businesses, assess financial information, and determine creditworthiness based on established criteria.

- Conduct financial analysis: Analyze financial statements, credit reports, and other relevant data to assess the applicant’s ability to repay the loan and manage credit risk.

- Assess collateral and security: Evaluate collateral or security offered by loan applicants and determine its value and adequacy to mitigate potential credit risks.

- Verify documentation: Ensure that all required documents and information provided by applicants are complete, accurate, and comply with internal policies and regulatory guidelines

- Collaborate with stakeholders: Work closely with loan officers, underwriters, and other internal teams to gather additional information, clarify details, and ensure smooth loan processing.

- Maintain credit files: Maintain accurate and up-to-date credit files and documentation, including loan applications, financial statements, and other relevant records.

- Monitor credit portfolio: Monitor the performance of existing loans, review repayment patterns, identify potential credit concerns, and take appropriate actions to mitigate risks.

- Ensure compliance: Adhere to regulatory requirements and internal policies related to credit evaluation, loan processing, and customer data confidentiality.

- Provide exceptional customer service: Communicate effectively with applicants, providing clear explanations of credit decisions, addressing inquiries, and ensuring a positive customer experience.

Skills And Qualifications

- Bachelor’s degree in finance, accounting, or a related field. Relevant certifications or professional qualifications in credit analysis are a plus.

- Proven experience as a Credit Officer or similar role in a financial institution, preferably in a digital banking environment.

- Strong analytical skills with the ability to interpret complex financial information and assess credit risk.

- In-depth knowledge of credit evaluation techniques, loan underwriting principles, and regulatory requirements.

- Familiarity with digital banking platforms and loan management systems.

- Excellent attention to detail and strong organizational skills.

- Ability to work independently and make sound decisions within established guidelines.

- Effective communication and interpersonal skills.

- Proficiency in using financial analysis software and MS Office applications.

- Commitment to maintaining confidentiality and handling sensitive customer information ethically.

- Understanding of market trends, industry best practices, and emerging technologies in credit analysis and lending.

Credit Manager

Job Description

As the Credit Manager/Team Lead for Umba’s Logbook Loan Business, you will be responsible for overseeing the credit operations. Your primary objective will be to manage the credit evaluation process, ensure efficient loan disbursements, mitigate credit risks, and drive the overall success of the logbook loan portfolio. This role requires a strong understanding of the logbook loan industry, exceptional leadership skills, and a proven track record in credit management.

Responsibilities:

- Team Leadership:

- Provide effective leadership and guidance to a team of credit officers, including training, mentoring, and performance management.

- Set performance targets and ensure the team meets or exceeds them.

- Foster a positive work environment, encourage teamwork, and motivate the team to achieve departmental goals.

- Credit Operations Management:

- Oversee the end-to-end credit evaluation process, including reviewing loan applications, assessing borrower eligibility, and determining loan amounts.

- Develop and implement efficient credit policies, procedures, and workflows to streamline loan disbursements.

- Collaborate with other departments, such as sales and collections, to ensure seamless credit operations and customer satisfaction.

- Risk Assessment and Mitigation:

- Evaluate creditworthiness of loan applicants by analyzing financial statements, credit reports, and other relevant documents.

- Conduct thorough risk assessments and make informed decisions regarding loan approvals and rejections.

- Implement effective risk mitigation strategies to minimize default rates and delinquencies.

- Monitor the loan portfolio performance, identify potential credit issues, and take proactive measures to mitigate risks.

- Compliance and Regulatory Adherence:

- Stay up-to-date with relevant lending laws, regulations, and best practices in the logbook loan industry.

- Ensure compliance with all legal and regulatory requirements in credit operations, documentation, and customer data management.

- Collaborate with compliance officers to implement necessary measures to adhere to anti-money laundering (AML) and Know Your Customer (KYC) policies.

- Reporting and Analysis:

- Generate regular reports on credit portfolio performance, including key metrics, trends, and risk analysis.

- Provide insights and recommendations based on data analysis to optimize credit processes, improve portfolio quality, and enhance profitability.

Qualifications and Experience:

- Bachelor’s degree in Finance, Business Administration, or a related field. A master’s degree is a plus.

- Proven experience (5+ years) in credit management, preferably within the logbook loan or consumer lending industry.

- Strong understanding of logbook loans, collateral evaluation, and risk assessment methodologies.

- Excellent leadership and team management skills, with the ability to inspire and motivate a diverse team.

- Sound knowledge of lending regulations, compliance frameworks, and credit risk management practices.

- Analytical mindset with the ability to interpret data, generate insights, and make data-driven decisions.

- Strong problem-solving and decision-making abilities in complex credit scenarios.

- Excellent communication skills, both verbal and written, with the ability to interact effectively with internal teams, external stakeholders, and customers.

- Proficient in using credit management software, Microsoft Office Suite, and other relevant tools.